London & Edinburgh Trust PLC

London & Edinburgh Trust PLC (‘LET’) was formed in 1971 and listed on the London Stock Exchange in 1983 with a market capitalisation of £27 million. LET grew into a leading international property development and investment company, with interests throughout the UK, continental Europe, the United States and South–East Asia. In 1990, LET was acquired by a Swedish pension and life assurance company, SPP Försäkringsbolaget, for £510 million as a platform for its global real estate asset management operation.

*IRR From IPO in 1983 To Sale In 1990: Includes 88% Ownership Of LET Pacific.

Let Pacific

Alpha Real Capital

Europa Capital

Europa Capital is a pan–European real estate investment management business. Europa Capital has invested over €11billion in a variety of transactions across 11 countries within Europe, ranging from substantial single assets and portfolio acquisitions to buy–outs. Europa Capital invests on behalf of over 100 institutional investors drawn from North America, Europe, the Middle East, the Far East and Australasia. Europa Capital was recently sold to Rockefeller Group, a subsidiary of Mitsubishi.

Portfolio Holdings

AIG French Property Fund

The AIG French Property Fund was established in 1998 and was co–sponsored and jointly managed with AIG Global Real Estate Investment Corporation. The Fund invested €754 million in eleven commercial real estate transactions in Paris. Investors received an IRR of 22% and 1.7 x equity multiple.

Property Mezzanine Partners

Pacific and York

In the years post the 2008 credit crunch, the UK housing market saw major volatility as a result of the banking crisis. Property prices were driven markedly downwards in parallel with market confidence. Against this backdrop, in early 2010 Pacific formed a new company, Pacific and York, to acquire blocks of newly built apartments at significant discounts to their open market value. These apartments were let on AST’s generating double digit yields. After a holding period of 5 years, the units along with their freeholds were sold either as a block to institutional investor or as individual units in the open market.

Pacific Investments Asia

Pacific Investments Asia was a joint venture established to invest in real estate opportunities in South East Asia. It developed two distribution warehouse near Bangkok, Thailand for Unilever under a long-term lease and at 45,000m² this was the largest such warehouse in South East Asia at the time of its development. A second 60,000 m² warehouse was completed and leased to Unilever in 2014.

Trinity River Developments

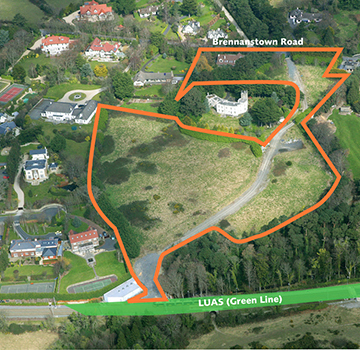

As a results of the Celtic Tiger that hit Ireland in 2007, Pacific identified an opportunity in 2011 to buy distressed residential land in Dublin at heavily discounted prices with a view to building houses. Being the first major acquirers of land after the crash enabled Pacific along with it’s JV partner Starwood Capital to acquire 3 sites covering 8 acres, all with various planning outlines. The strong rebound in land and house values meant that all 3 sites were sold off before development began, generating an IRR in excess of 80%.

*IRR Represents Combined Pacific And Related Party Returns.

Red River USA

In 2011 Pacific started Red River USA LP, a partnership designed to acquire single family houses from foreclosure auction sites in the suburbs of Miami, USA. Overall 30 homes were purchased and subsequently refurbished and once tenanted generated double digit yields. The houses were held for 2 to 3 years and gradually sold off after significant capital appreciation.

Gatti House, The Strand

In 2013 Pacific Investments entered into a joint venture to acquire the Adelphi Theatre, a Grade 2 listed building in the Strand. Planning consent was obtained to convert the building into 4 luxury apartments in excess of 5250 sq ft with A3 usage on the ground floor pre-let. The apartments were sold during the first half of 2015 achieving record prices for the Strand.

Lennox Gardens

In 2011 Pacific Investments simultaneously acquired five off market apartments in Lennox Gardens with the vision of creating one stunning triple lateral apartment in one of London’s most desirable addresses. The project took over 2 years involving complex license negotiations with three different freeholders, the enfranchisement of two of the apartments, multiple planning applications, extensive discussions with listed building control and meticulous attention to the overall build quality and finish. The result was a super prime luxury apartment, which achieved a price in excess of £4,500 per sq foot.

Le Patio, Puteaux

Following the acquisition of the site in 2001, Pacific established a Long Lease with Urban Soccer, who utilised the site as a 5-a-side football club. Pacific worked up a proposal for a 146 Residential scheme on the site, and based on the proposals, received an off-market offer in Jan 2020 which was accepted. The site was sold in Q2 2020, realising a 12% IRR.

European Logistics

European Logistics Real Estate Partners is a pan European property company established in April 2018.

It invests in build-to-suit and speculative logistics projects across Europe with a focus on addressing the closer integration of logistics and retailing across the Continent. It completed its first deal in Schiphol, Amsterdam in September 2018.

Occupier demand in Europe is in the midst of a structural change driven by e-commerce, technological advances and the wider drive for supply chain optimisation. The manager will look to build a well-diversified portfolio of assets which fulfil key roles in the supply chain of occupiers and focus on major population centres and logistics terminals.